真有創意!

還真沒想過可以用這樣的LEGO方式砌幅模型車牆出來!

還真沒想過可以用這樣的LEGO方式砌幅模型車牆出來!

姣婆守唔到寡…

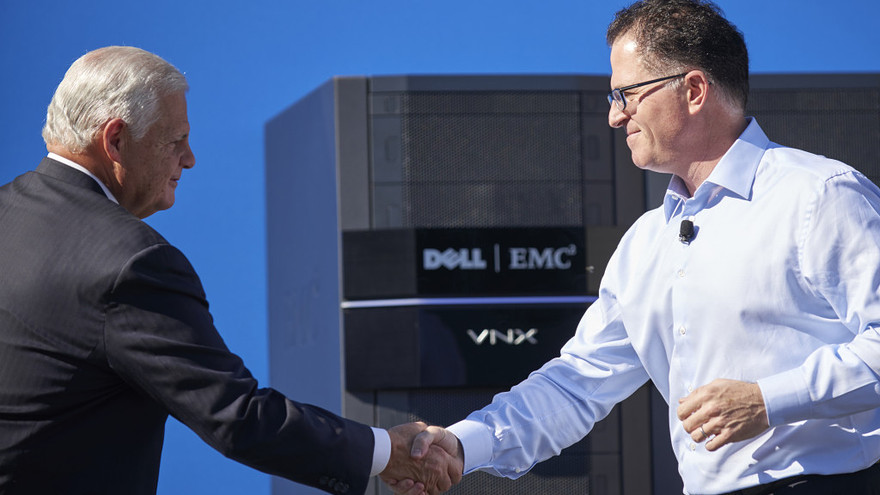

Dell Inc. founder and Chief Executive Michael Dell, right, and EMC Corp. CEO Joseph Tucci shake hands in an image provided by Dell after the merger of the two tech companies was announced Monday morning.

Dell Inc. is making its biggest move ever to expand beyond its personal-computing roots and compete directly with Hewlett-Packard Co.’s corporate business, buying EMC Corp. EMC, +1.76% But there are worrisome aspects to the largest tech deal in history.

One is the hefty debt load privately-held Dell is taking on in order to do the deal. The company expects to pay for the deal with cash on hand, a debt issuance and through the creation of a stock that will track Dell’s ownership interest in EMC’s virtualization software business, VMware Inc. VMW, EMC shareholders will receive $24.05 per share in cash and approximately $9.10 per share in the newly created VMware tracking stock, which didn’t seem to please VMware investors: While EMC’s stock ticked up slightly on the news, which was first reported last week, shares of VMware fell 8% Monday.

Dell hopes to pay down some of the debt through cost-cutting and the elimination of duplications and redundancies in the company. Michael Dell, the CEO of the company he founded in his college dorm in 1984, assured investors Monday the company was not taking on more than it could handle, even amid a threat of potential rising interest rates.

“I think what you’re going to see is in the first 18 months to 24 months, a significant de-leveraging coming from some cost synergies,” Dell told reporters on a conference call. ‘We have revenue synergies that are three times larger.”

Executives, though, declined to be more specific about what areas could see cuts or restructuring, preferring to focus on the more amorphous “revenue synergies,” which they told analysts were about $1 billion.

Analysts were not too keen on the idea that the companies would be looking to issue debt in an environment of rising interest rates.

“We still believe raising $33 billion plus in debt at reasonable interest rates will be challenging (but not impossible) for Dell,” Jeffries & Co. analyst James Kisner said .

Sanford Bernstein analyst Toni Sacconaghi said in a note on Monday that he believes Dell will have to raise about $45 billion in debt to finance the deal and that he was “a bit surprised that Dell was able to get financing,” according to the Wall Street Journal.

Meg Whitman, the chief executive of Hewlett-Packard HPQ, +0.00% believes Dell is going to face an ominous task raising that much debt, and she hopes H-P can take advantage of the confusion among customers as the companies embark on this massive deal.

“To pay back the interest on the $50 billion of debt that the new combined company will have on their balance sheet, Dell will need to pay roughly $2.5 billion a year in interest alone,” Whitman said in a company-wide email to employees obtained by MarketWatch. “That’s $2.5 billion that they will allocate away from R&D and other business critical activities, which will keep them from better serving their customer.

While Whitman’s comments can be seen as self-serving, H-P has its own experience with big mergers that sucked up its cash, notably the $11 billion deal for software company Autonomy, most of which it later wrote off. H-P also wrote down a huge chunk of its $14 billion acquisition of EDS, a computer services company, both moves that H-P did in a similar push for enterprise-focused businesses.

Whitman, whose tenure at H-P started with a mandate to strengthen the company’s then-weakened cash balance, contended that the company is “two years ahead of the game,” as it prepares for its own separation of its corporate server business from its printer and PC business at the end of this month.

“We’re organized, we have a strong balance sheet and our innovation engine is humming,” Whitman wrote. “So, get out in front of your customers and your partners. Tell them our story. Take advantage of this moment.”

In addition to the hefty debt load Dell is going to be saddled with, the company is going to have to again publicly report its financial results, as a result of its new tracking stock. EMC Chief Financial Officer Zane Rowe told analysts on a conference call that along with the tracking stock, “we would expect Dell to report financials.”

“We’ll become an SEC registrant and will report financials on their business as well as the VMware business,” Rowe said.

So in addition to adding on a pile of debt, Dell — which seemingly enjoyed being out of the public limelight as a private company — is now going to be foisted into the public glare again. At least investors will be able to track its progress in this mega-merger, but it’s unlikely to be an easy road.

(Market Watch)

這個日本收藏家的網站幾乎網羅了所有的1比43 F1/Le Mans/WRC車型,而且每頁都很用心的附上了不少精彩的賽事視頻。

btw, it’s not mine…yet…

真有情懷!

兩位手版大師的合照: 左邊是日本的稻葉精大師,有右邊是新加坡GARAGE43的Laurent大師!

GT-Spirit的第一款法拉利預計11月面世,其實是個Testarossa的Koenig Competition Evolution 1000hp改裝版,所以應該照樣沒有正式的法拉利版權。

看樣板感覺整體外型存在著根本的錯誤,另外各個部件的縫隙巨大,照理樹脂膠不應存在如此低級的錯誤,還有就是內飾的做工實在也太塑料了,最後竟然連尾翼也是彎的。

奇怪怎麼最近各個廠家的QC都這么差,難道是內地的工資上漲,導致車模師傅都跳槽了不成? 這叫車模收藏家如何是好?

剛看到以下這篇CMC總裁贾女士的回復,自圓其說的解釋未免感覺有些牽強。

跟我原先的估計一樣,CMC這次真的沒有給法拉利任何版權費用,請問這跟EXOTO一直走的法律灰色地帶有什麼分別?

好了,另一個問題來了,如果沒了那1/3版權費用的成本,為什么這次售价沒降下來加上這次樣子嚴重走型反到比以前還要貴呢?

沒有版權但合法!好像哪裡聽過,這話說實在的,听着還真別扭。

沒錯沒有版權就 = 山寨,但為什麼CMC不早就這麼做呢…而要等到現在才有此出乎意料的舉動呢?

“該模型為生產于25年前之車型的高精度比例模型。任何設計在發布25年之后都將自動被划歸為公有領域,不受版權保護。”

言下之意之前那麼多CMC的經典都没给版權費用了?

因為根據CEO賈奶奶那個堂皇的25年以上的車都不需要版權的這個理論,我也特別想知道以前那些CMC產品的版權是真的還是假的﹖但怎麼看也不像假的啊﹖因為全都有雷射+品牌標籤。這麼一來,賈奶奶豈不自己打自己嘴巴不成? 罪過啊。:)

如果是為什麼還賣得這麼貴呢? 另外為什麼CMC以前一直強調不停地加價是因為版權費用的上升呢﹖這豈不是來的有些虛偽和自相矛盾嗎?

衷心希望這不是一個大話蓋過另一個大話。

嗯,看樣子兩邊怎么講都講不通吧,這個問題的確是車模界本年度的一大謎團,請問誰可以解開呢? 呵呵。 ![]()

没有版权但合法! CMC关于法拉利250GTO的官方答复

在CMC官网发布250GTO消息之后,熊君第一时间与CMC贾老进行了沟通,关于大家关心的版权问题有了清晰的答案。

贾老表示CMC确实没有与法拉利续签合约,但这绝不是钱的问题。贾老没有透露太多细节问题,不过法拉利喜欢在版权问题上找模型厂家麻烦,这之前大家也都是有所耳闻的。。。

贾老格外强调:“我们这次推出新车,受到了德国法律界及工商界支持。西姆斯是一个一贯认真负责的公司,我们非常在乎自己遵纪守法的形象。这款西姆斯的法拉利GTO1962年版,没有许可证但是合法的。”具体内容请参见最后的翻译资料。

现在我们清楚的知道,CMC即将发布的250GTO没有版权,但这并不违法。至于没有版权的模型在收藏价值方面是否有所影响,还请大家积极发表自己的看法!

在得知失去法拉利支持之后,熊君的第一反应是这是否会影响到模型的精准度,对此贾老做出了出人意料的答复:

“西姆斯的车模并不取决于车厂支持。你一定好奇为什么?除了奔驰有过大力帮助,我们很少获得图纸支持。车厂更不可能提供3D图纸 (老爷车的那个年代也没有这种现代图档)。这也可能是老爷车很少有人做车模的主要原因。因为我们主做老爷车,而老爷车的技术资料又非常少。所以我们有比较强的技术队伍,以弥补这个缺憾。包括德国西姆斯本公司的技术力量,还有外围的多个专家和顾问。当我们选择了一个车型后,一定会动用所有技术力量,对这个车做彻底了解,也一定亲自上门去做实地考查,激光测量,数千张照片和录像。在开发过程中,每一阶段都要反复去对比真车,请各专家鉴定,比如布加迪Corsica,因为远在美国加州,我们亲自去了两次,并请车主参与鉴定,还去法国的布加迪公司进行鉴定。。。。所以一个车模的完成,往往需要两年甚至更长的时间,这也是我们为什么主做老爷车?因为从开发时间和进度上,我们无法和制作简单车模的公司在时间上进度上竞争,我们需要反复推敲和精工细作。”下面是上文所说的那份资料,介绍了一下关于模型版权的法律问题,大致内容翻译如下,括号内部分为是我的标注:

生产和销售这款高精度比例模型不需要任何授权,特别是不需要车厂授权。该模型为生产于25年前之车型的高精度比例模型。任何设计在发布25年之后都将自动被划归为公有领域,不受版权保护。(法律这样规定的理论基础和是说任何人都不是凭空创造出“设计的”,而是站在巨人的肩膀上,利用前人知识成果进行创作,所以他本人或这个公司无法永远拥有这种版权。)根据欧共体法院(ECJEuropean Court of Justice )以及德国、西班牙、意大利等国法院的规定和判例我们可以知道,以忠实还原真车为目的,在汽车模型上使用汽车厂商商标不构成对商标所有者的侵权。具体判例可参见ECJ在2007年1月25日的判决书(Case C-48/05 ),以及德国联邦高等法院2010年1月14日的判决书(I ZR 88/08)。

因此,CMC所生产的250GTO模型在法律层面不存在任何问题。

无奈熊君